Last month, I did a write up of our Debt Free Scream on The Dave Ramsey Show. Dave usually asks lots of questions to shape the story in these segments. I kind of just…talked the whole time. So, with my apologies to the man himself, here are answers to questions Dave USUALLY gets to ask:

Dave: “What do y’all do for a living?” I’m a corporate trainer for a health insurance company in upstate NY, Courtney is a music therapist. She opened her own practice a few years ago, and now – as a full-time mom and part-time business owner – she’s still able to bring in a nice residual income to boost the household budget. She also brings in $1,500-$2,500 selling books, music, collectibles, and other household odds and ends online each year.

Dave: “What was all this debt on?”

- The first $55,000 of the $197,000 was my personal debt, accumulated before I met Courtney. I had most of it paid off by the time I met her. The lion’s share was student loans and a car loan (for a brand new car I bought while making $12/hour), the rest was credit cards (including store cards like Guitar Center, where I racked up quite a balance in music gear!) and cash advances (at 24% to 28% interest!) which I took during a short period of unemployment.

- The mortgage on our house was the other $142,000. We set a goal early on to pay it in 5 years. We made it in 5 years and 3 months, which isn’t bad considering we also cash-flowed around $25,000 in home improvements; $5,000 in dental surgery for me; and $8,000 in baby expenses leading up to and including the birth of our son last November.

Dave: “What woke you up that something needed to change?” I talked about my cancer diagnosis in the video, and I’ve written about an earlier “Slap in the face moment” as well, but the very first wakeup call I remember was standing in line at an upscale grocery store in Manhattan Beach, California in 2004. There I was, wearing $300 jeans, but frantically flipping through my credit cards to find one with enough room left to let me eat for the week. It was the first time the mask slipped in the mirror, meaning I had to see what was real, not just the front I was putting up. I didn’t make any major changes right away, but that was when the seed was planted that I needed to get out of L.A. and get back to being REAL.

Dave: “What was the stupidest thing you did with money?” The stupidest thing I did with money wasn’t the biggest money mistake I made. I had student loans and car loans and other big ticket items like that, but the BIG stupid happened in the smaller decisions. I once talked myself into buying a $500, chef-quality set of Calphalon cookware, convinced I would cook more if I had a good set. I probably made chili with the big pot twice before it got packed away in a move and left packed when I realized I didn’t have space for it. It sat in my landlord’s garage for years, a monument to my stupidity. A few years ago, now married to a fabulous cook and living in a full-sized home, I took it out of storage and we’ve been using it daily ever since. It was a small redemption milestone, but it felt good.

Dave: “What do you tell folks when they ask how you paid off $197,000 in 8 years?”

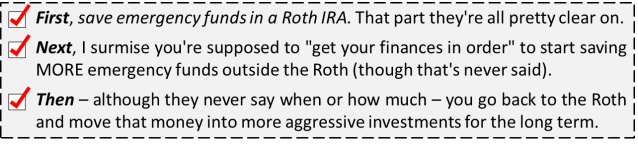

- First and most simply; the Dave Ramsey plan just plain WORKS. I’ve read every major personal finance author, and they all have you trying to do six things at once, and they all want you to “manage your debt” so you can “maintain your credit”. By focusing on the first right thing to do – to the exclusion of all else – before moving on to the next right thing, you gain momentum and get things DONE. By eliminating debt completely, and recognizing that you don’t need it (and therefore don’t need a credit score) to thrive, you bring stability to your finances and your life, which is a powerful place to plan and dream from. You make better decisions because you don’t have your negative financial history whispering in your ear.

- But even that great plan would not have been effective if we hadn’t learned to dream better dreams. Not bigger, but BETTER. What I mean is that I used to dream about a nicer car or a bigger paycheck or taking a cool trip. After I got sick, looking down the barrel of a 25% chance of living the next five years, my dreams changed to having more and better time with my friends and family, and the peace to truly enjoy what time I had without distraction. After I recovered, I maintained that perspective, and it radically re-shaped my priorities. Now, I wanted to live and make decisions that weren’t influenced by the debt I accumulated or the bills I had to pay. Once those dreams were in place, our goals became far more inspiring and motivating, which made what I would have thought of as sacrifices (like cancelling cable and cell phones, skipping vacations, and downgrading in car) feel like opportunities, and the work (like multiple mortgage payments) felt like a game we enjoyed playing every month.