In the last year, a dangerous fad has taken root in mainstream personal finance theory that I’ve dubbed the “Emergency Roth” (trademark pending). The basic premise is to use a Roth IRA to save an emergency fund. I don’t know where it originated, but this idea is being parroted by many herd-following financial writers (see the list at the bottom of this post). But as is often the case with these trendy financial sound bites, the inconsequential upside is being loudly touted while the potentially huge downside is completely ignored.

Before I break it down, I’ll let Erik Carter at Forbes.com (“10 Common Money Management Mistakes That You’re Probably Making”) explain the basic concept:

Before I break it down, I’ll let Erik Carter at Forbes.com (“10 Common Money Management Mistakes That You’re Probably Making”) explain the basic concept:

“One of the best places to start [saving for emergencies] is in a Roth IRA. That’s because whatever you contribute to a Roth IRA can be withdrawn tax and penalty free for any reason at any time and whatever you don’t withdraw grows to be tax free after age 59½. This way you can build an emergency fund and save for retirement tax free at the same time. Just be sure to keep the money invested somewhere safe and accessible like a money market account or fund until you have adequate emergency savings elsewhere.”

Too Good to be Intelligent: There are four major problems with this strategy:

The entire purpose of a Roth IRA is to grow your investments free of taxes. Who cares about saving taxes on an account earning 1%!? You can only save $5,500 per year per person into a Roth IRA ($6,500 over age 50). At 1% interest (above average for a money market) that’s a whopping $55/year which — at a 25% tax bracket let’s say — results in an annual savings of $13.75…THIS is their big game changer?

Yes, you can access contributions into a Roth without penalty at any time, but when you do an insidious and overlooked trap closes on you: Once it’s spent, that year’s contribution limit, and tax-free growth potential, are gone. Emergencies happen, and if this is your emergency plan, you will tap into it.

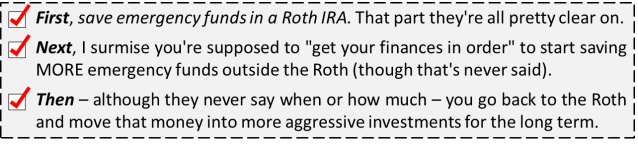

So now we know the benefit is almost negligible, and you can’t replace money you pull out. Those are bad, but at least it’s complicated and vague! None of these authors tell you how this works in your overall plan, but after reading several of these, I have an inkling of what the end-to-end process should be:

So it’s ineffective, complex, and vague, and its success (paltry as it is) hinges solely on repeated manual intervention. For the average American worker with Roth access, that’s just not going to happen. First, the idea assumes there will be money left (just earmarking the funds for emergencies makes that less likely than if it were earmarked for retirement). Second, it assumes the person will be proactive enough to set up additional, non-Roth emergency funds later, and THEN remember to come back and change the investments in the Roth to reset it for retirement. It all adds up to a lot of work, and unnecessary risk, for almost zero upside.

A Conga Line of Dumb: Saddest of all, the trend is growing: Money Magazine, US News, Forbes, The Wall Street Journal, Investopedia, the Seattle Times, and even Suze Orman (in her most recent PBS special) are now championing this nearsighted tactic (a short list is below, there are many more). I have to wonder if their jobs are to simply read and regurgitate from some common financial feed like lab mice at a pellet dispenser, or if they are so desperate to put out something, anything new that they don’t bother to critically examine a new concept, instead jumping on any bandwagon with both feet to beat the next three sheep in the flock to print.

The Bottom Line: Yes, there is an infinitesimal mathematical benefit to be gained with this tactic, but it trusts to multiple steps of manual intervention for the follow-through to make even that pittance work. More dangerously, it gives the illusion of doing two smart things at once (saving for emergencies and saving for retirement), but at the result of doing both of them poorly.

My recommendation — as usual — is to keep things simple: Save first for emergencies in a savings account or money market, and STOP when you have enough (3-6 months of expenses). THEN start investing regularly for growth in your Roth IRA, 401(k), and/or other tax-advantaged options available to you. Oh, and get out of debt before you worry about retirement investing. The fact of the matter is that the number one reason people raid their retirement accounts is DEBT, with emergencies as a close second (TIAA-CREF, “Should You Borrow From Your Retirement Plan?“). So becoming debt-free and building an emergency fund isn’t just a great way to reduce stress and instability from your finances, it’s bona fide retirement insurance. And that’s not a product you can buy, it’s a foundation you build for yourself and your family.

Article List:

- Money Magazine, July 2015 issue: “Never Worry About Money Again” (p. 44, under Put Your Roth IRA on Double Duty) by Carla Fried, Ian Salisbury, and Taylor Tepper

- Forbes: “10 Common Money Management Mistakes That You’re Probably Making” (under mistake #5) by Erik Carter

- US News & World Report MONEY: “Can a Roth IRA be Your Emergency Fund?” by Miranda Marquit

- WSJ: “Keep Emergency Fund in Cash or Invest?” by Andrew Blackman

- Seattle Times: “Roth IRA can be a backup emergency fund” by Gail MarksJarvis

- Investopedia: “How To Use Your Roth IRA As An Emergency Fund” by Amy Fontinelle